For Free Consultation Reach Us At +966 55 627 2741

Most Trusted E-Invoice Software by Saudi Businesses

ZATCA Approved E-Invoicing Software for Professionals in Saudi Arabia

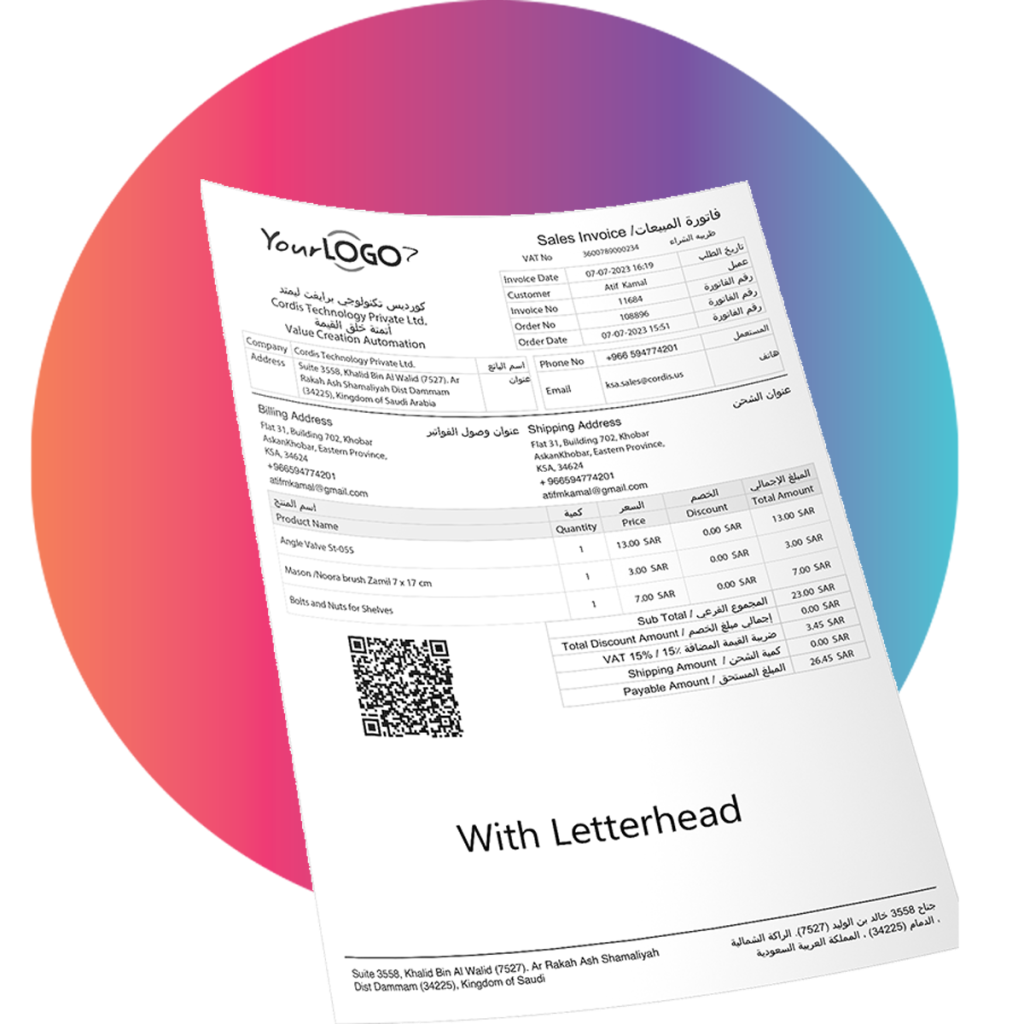

- Generate QR Code Invoices and PDF/A-3 with XML for Seamless Transactions.

- Multilingual Support: Works in Arabic and English.

- Choose the Flexibility of Cloud-Based or On-Premises Solutions.

- Invoice Program with Multiple Templates for Every Business Need.

- Track and Manage Your Invoices with Powerful Invoice Tracking Software.

- Mobile-Friendly Invoice App for Invoicing on the Go.

- Trusted by Contractors, Trading Firms, Restaurants, and More.

Book A Demo

Latest

Wave

Wave 22

Integration

Implementation

Deadline

31st Dec, 2025

Annual VAT Revenue

> SAR 1 Million

Shabakah's Advanced Features: Best Invoice Management System in Saudia Arabia

Customize Invoices for Your Business

Automated Invoice Processing for Efficiency

PDF/A3 with XML Code for ZATCA Compliance

Instant Invoice Delivery via Email

Track Invoice Status in Real-Time

Generate Accurate Invoice Clearing Reports

Fully Integrated with ZATCA’s Fatoora Program

Support for Multiple Languages

Active Users

0

+

System Uptime

0

%

Customers Satisfaction

0

%+

Start Issuing ZATCA-Compliant Invoices for 100% Free – Easy to Use, Customize, and Send!

01

ZATCA Notification for Fatoora Portal Integration

02

With Us Get Onboard With ZATCA In 5 Min

03

Create Your Teams/ Users

04

Add Your Customers & Products/Services

05

Create Invoices Digitally Passed By Fatoora Portal

06

Share With Customers or Download Digital Copy

Upcoming

Deadline

Wave 15

Integration

Implementation

Deadline

31 May, 2025

Annual VAT Revenue

> SAR 4 Million

All Taxpayers in Waves 1-12 with revenue over 25M SAR must integrate or may face penalties.

Top-Rated E-Invoicing Software in Saudi Arabia for Effortless Invoice Management and Compliance

Feature

Highlights

Accurate VAT Details Management

Efficient Tax Handling

Secure Digital Storage & Archiving

Instant Invoice Tracking

Phase II ZATCA Compliance

Accurate VAT Details Management

Efficient Tax Handling

Secure Digital Storage & Archiving

Instant Invoice Tracking

Phase II ZATCA Compliance

Fast Configuration &

Clear Reporting

Customizable Invoices for Every Business Need

Seamless Integration with Your Systems

Instant Generation of E-Invoices

Advanced Reporting for In-Depth Insights

Phase 2

Compliant

Customizable Invoices for Every Business Need

Seamless Integration with Your Systems

Instant Generation of E-Invoices

Advanced Reporting for In-Depth Insights

Technical

Specifications

ZATCA Compliance Integration

QR Code for Tax Invoice Generation

XML Invoice Generation

Comprehensive Technical Support

Seamless ZATCA API Integration

ZATCA Compliance Integration

QR Code for Tax Invoice Generation

XML Invoice Generation

Comprehensive Technical Support

Seamless ZATCA API Integration

Security &

Compliance

Data Protection & Security

Previous Invoice/Note Integrity

Access Control Management

OCSP Responder Integration

Cryptographic Validation

Secure Data Transmission

Data Protection & Security

Previous Invoice/Note Integrity

Access Control Management

OCSP Responder Integration

Cryptographic Validation

Secure Data Transmission

Book a 100% Free Appointment

Quick Integration

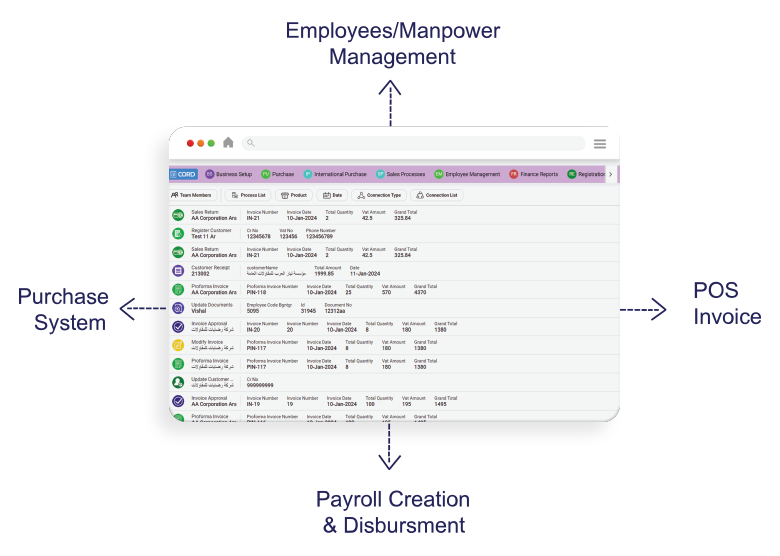

Quick and Easy E-Invoice Integration with Your Existing Systems

ZATCA E-Invoicing Integration Process

Effortless Integration with Core Business Modules

- Employee & Manpower Management with invoicing integration.

- Payroll Creation & Disbursement made easy with online invoice software.

- Complete Accounting System that aligns with e-invoicing software in Saudi Arabia.

- POS Invoice system compatible with electronic invoicing system.

- Purchase System integration with invoice tracking software.

E-Invoicing Fatoorah Software for leading industries

Stay protected from fraud and meet consumer demands while staying smart with the electronic invoicing software

Freelancer

Contractor

Manufacturing

Banking & Finance

Retail & Wholesale

Healthcare

Hospitality

Electronics

Automobiles

Agriculture

Cosmetics

Education

Have Questions About ZATCA E-Invoicing?

Get Expert Legal Advice from One of Our Top Legal Consultants.

Frequently Asked Questions

What is ZATCA Phase-II E-Invoicing?

ZATCA Phase-II mandates that businesses in Saudi Arabia use e-invoicing software for real-time transmission of tax invoices. This involves integrating with ZATCA’s platform to comply with the electronic invoicing system.

Is Shabakah E-Invoicing Software ZATCA compliant?

Yes, Shabakah is fully ZATCA-approved. It ensures that your invoices comply with the Saudi tax authority’s regulations, including generating XML files, QR codes, and certified invoice formats.

When did Phase-II E-Invoicing commence in Saudi Arabia?

Phase-II e-invoicing began on January 1, 2023, for businesses with annual taxable revenues exceeding SAR 3 billion.

Can I Customize my Invoices in Shabakah?

Yes, Shabakah allows you to fully customize invoices, including the ability to choose from multiple templates, modify fonts, colors, logos, and select between service or product-based invoicing.

Who is required to comply with Phase-II E-Invoicing?

All VAT-registered businesses in Saudi Arabia, including those with revenues above SAR 3 billion, must use the e-invoicing software.

Can I generate Bulk Invoices using Shabakah?

Yes, Shabakah offers the ability to generate invoices in bulk and save time for businesses with high-volume transactions to ensure compliance with ZATCA regulations.

What are the key requirements for E-Invoicing under ZATCA?

Invoices must be generated electronically through invoicing software, including mandatory fields and secure storage.

Is there a Free Trial available for Shabakah?

Yes, Shabakah offers a 15-day free trial with no commitment required. You can explore its features and test its capabilities before making a purchase decision.

What is the Fatoora portal?

Fatoora is ZATCA’s platform for businesses to transmit and store their tax invoices to ensure compliance with the electronic invoicing system.

What is the deadline for integrating with ZATCA's E-Invoicing system?

Businesses with revenues exceeding SAR 7 million must integrate with ZATCA’s system by February 1, 2025.