For Free Consultation Reach Us At +966 55 627 2741

ZATCA E-Invoicing Middleware

Effortless & Reliable Solution Zatca E-Invoicing Middleware

The ZATCA e-Invoicing Middleware is a cloud-based solution that allows businesses to easily create, send, and receive electronic invoices. The middleware is fully compliant with ZATCA’s e-invoicing standards, and it can be integrated with most accounting software systems. The ZATCA e-Invoicing Middleware offers a number of benefits for businesses in Saudi Arabia.

Enhance ERP Connectivity:

Achieve ZATCA Integration Excellence with Shabakah Middleware

Our E-Invoicing Middleware Enables Seamless Compliance with ZATCA’s E-Invoicing Requirements.

Full Compliance With ZATCA Standards

Maximizing Business Efficiency & Compliance With ZATCA E-Invoicing Middleware

ZATCA e-Invoicing Middleware serves as a powerful tool to enhance business efficiency and ensure compliance with invoicing regulations. By automating manual tasks and streamlining invoicing processes, businesses can save valuable time and resources.The middleware is designed to meet ZATCA’s e-invoicing standards, providing businesses with the confidence that their invoices are generated in accordance with the prescribed formats and data requirements. Real-time visibility into invoicing processes enables businesses to identify and rectify errors promptly, maintaining accuracy and financial control.With customizable features to adapt to unique business needs, ZATCA e-Invoicing Middleware empowers businesses to optimize their invoicing operations and maximize efficiency while ensuring compliance with regulatory standards.

ZATCA E-Invoicing Middleware Features

Innovative Solution for E-Invoicing Excellence

Minimal Changes On ERP / Pos

Integrate With Your Existing ERP Or POS Systems With Minimal Changes Required We Understand The Importance Of Maintaining The Stability And Functionality Of Your Current Business Processes.

Seamless Implementations

ZATCA E-Invoicing Middleware Offers Seamless Implementations, Ensuring A Smooth Transition To Electronic Invoicing Without Disruptions Or Downtime.

Easy Reconciliations

Our Solution Streamlines The Reconciliation Process, Matching Invoices With Payments Effortlessly You Can Quickly Identify And Resolve Discrepancies.

Technical Support

Our Dedicated Team Assists With Setup, Troubleshooting, And Resolves Any Issues Promptly, Ensuring Uninterrupted Operations.

Fast Speed

Delivers Exceptional Speed, Enabling Swift Processing And Transmission Of Invoices Enjoy Accelerated Invoicing Workflows.

Full-Proof Security

We Employ Advanced Encryption And Authentication, To Protect Your Sensitive Information From Unauthorized Access Or Breaches.

Accurate Invoices

Ensures Accurate Invoices By Automating Data Validation And Verification, Minimizing Errors And Improving Invoice Accuracy.

Fully Compliant

Fully Compliant With Regulatory Standards, Ensuring Adherence To Legal Requirements And Simplifying Tax Compliance.

100% Efficiency

Operates At 100% Efficiency, Optimizing Invoicing Processes, Reducing Manual Tasks, And Maximizing Productivity.

Have A Query Related To ZATCA E-Invoicing?

Get Your Queries Answered From Our One Of The Best Legal Consultants

How Do We Ensure The Generation Of Compliant E-Invoices?

Penalty Avoidance Through Data Validations

Intelligent Data Validations For ZATCA-Compliant Invoices, Ensuring Accuracy And Error-Free Generation Of Invoice Data.

XML Generation In Compliance With ZATCA Standards

Effortlessly Generate UUID, Invoice Hash, Invoice Counter Value, QR Code, And Seamlessly Convert Invoices Into UBL 2.1 XML Format.

Streamlined Reporting Via ZATCA Integration

Seamless Integration With ZATCA For XML Invoice Clearance/Reporting And Receipt Of Certified XML Invoices.

PDF A/3 Invoices With XML Integration Simplified

By Incorporating Phase II QR Code And Certified XML Into The Existing Invoice, Our System Generates The Final PDF A/3 Invoice Seamlessly.

Streamlined Electronic Invoice Exchange

Effortlessly Share The Final PDF A/3 Invoice With Your Customers Using Automated Email Apis.

Data Validation Automation With Streamlined Accuracy

Validate Your E-Invoice Data Automatically To Ensure Compliance With ZATCA Norms And Regulations.

Easy Integration

E-Invoice Integration Is Possible For Any Of Your Existing Systems

Why ZATCA E-Invoicing Middleware Is The Best Solution For Your Business?

A Cloud-Based Solution That Offers Ease Of Use And Affordability. It Ensures Full Compliance With ZATCA’s E-Invoicing Standards While Providing Seamless Integration With Most Accounting Software Systems. Experience Seamless Efficiency And Cost-Effectiveness With ZATCA E-Invoicing Middleware.

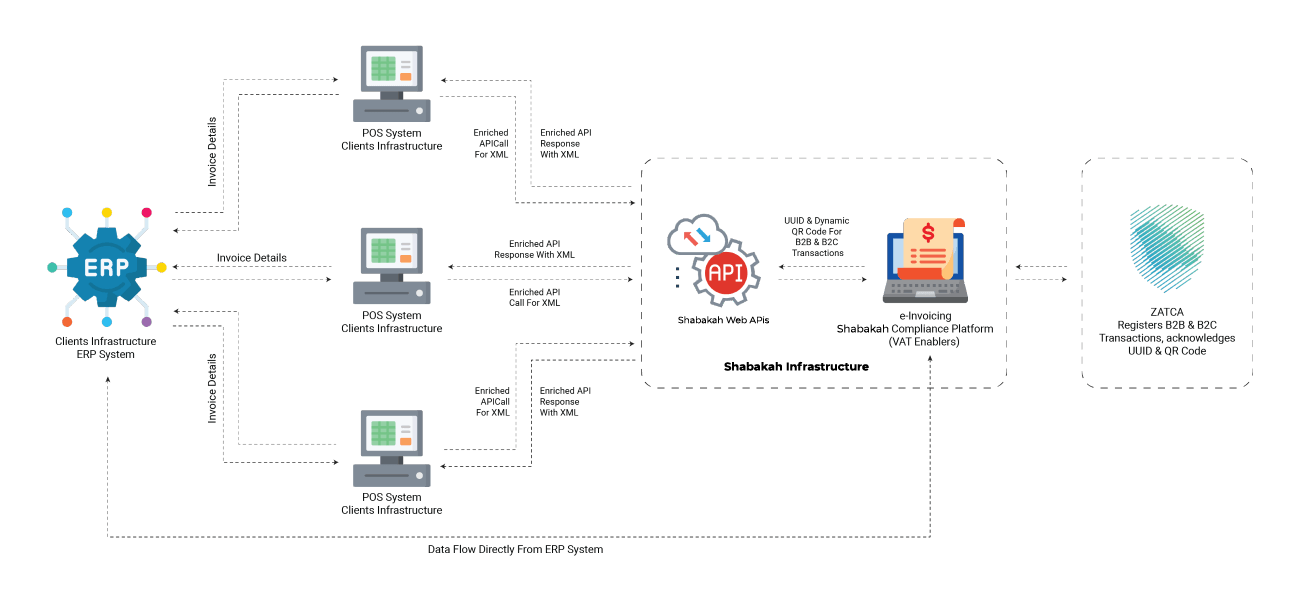

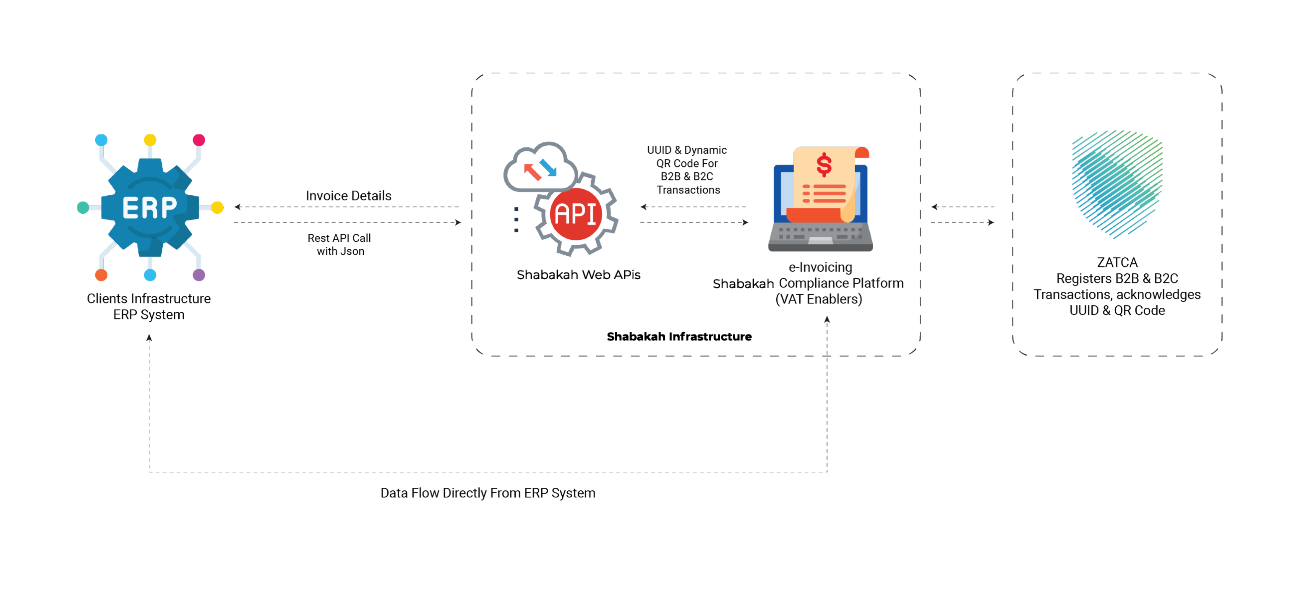

E-Invoicing Solution Flow Phase - II

Model-I

Model-II

Model-I

Model-II

Bridging The Gap With English And Arabic With Multi Language Feature

With The Multi Language Feature, Spa And Salon Businesses Can Effortlessly Switch Between English And Arabic Interfaces Within The Software. This Allows Customers To Navigate Through The System, Make Appointments, And Access Service Menus In Their Preferred Language.

Frequently Asked Questions

E-invoicing software is a must-have for every organization in KSA. It is a standard requirement implied by Zakat, Tax, and Customs Authority (ZATCA) and should be followed by everyone. This requirement is imposed on businesses to have streamlined procedures and efficient working.

Shabakah helps you integrate fully compliant software in your organization, fulfilling all the strict regulations of Zakat, Tax, and Custom Authority (ZATCA). Whether it be your accounting software, sales, or purchase, it is pre-integrated with other software, so you don’t have to hustle for that. Incorporate Shabakah’s E-invoicing software in your organization to escalate the growth of your working operations and handle taxes in an authentic and organized way.

The ZATCA compliant Fatoorah E-invoicing system holds two types of invoices:

- Standard invoice.

- Simplified invoice.

Standard Invoice:

Well, the standard invoice which is also known as tax invoice, is mainly issued for B2B business and B2G transactions. The type of invoice is utilized for demanding vat input deduction by buyers.

It has to be very clear to the buyer that in phase 1 these invoices can be shared in a given format with the buyer however in phase 2 these invoices could be shared after being evident by ZATCA and cryptographically stamped. Also, the VAT registration number should be added to the invoice if the buyer is VAT registered.

Simplified Invoice:

A simplified invoice is issued to B2C transactions only with the QR code generated from your system. The buyer doesn’t need to hustle manually. However, the QR code is an essential factor to differentiate your invoice from others. These invoices can also be self-billed, but the system will indicate this on the invoice.

There are two phases in which you can enforce an electronic invoicing system in your organization.

Phase 1:

Phase 1 is invoked from 4th December, 2021 and is known as the “generation Phase”.

Phase 2:

The second phase of electronic tax invoice is going to be implemented by 1 Jan, 2023. Therefore, the taxpayers will be informed at least six months before their integration phase starts.

Well, the technical requirements are mostly satisfied by the internal team members in case of in-house built solutions, or service providers (ECR vendors, or software vendors). The taxpayer needs to consult a service provider to comply with electronic invoice processing systems in their organization, or the internal team member to update and comply with the system by 4 Dec, 2021.

The specific requirements are applicable to both the phases, however differs with respect to the type of invoice.

- Use of electronic systems to generate invoices.

- QR code is a must on tax invoices.

- Invoice title. (depending on the type of invoice being generated)

- VAT number should be written on the invoice.

- Invoices in XML format.

- Safety from fraudulent attacks. (Anti-tampering feature)

- Integration with ZATCA system

- A few technical requirements (E.g. UUID)

Considerably, these requirements and phases are applied to all the people who are compliant with the VAT regulations or VAT registered.

The data being shown on a simplified tax invoice after scanning from a QR code is listed below:

- Seller’s name.

- VAT registration number of the person.

- Date and time stamp.

- VAT total.

- Electronic invoice total with VAT.

- The 1st phase deadline is Dec 4, 2021 given by Zakat, Tax & Customs Authority (ZATCA).

- The 2nd phase will be enforced by Jan 1, 2023 which will be implemented in waves.